michigan gas tax increase 2021

Throw in the 184. The FAQs on this page are effective January 1 2022.

Michigan At Significant Risk Of A 2021 Tax Hike Mackinac Center

Listen to Free Radio Online Music Sports News Podcasts.

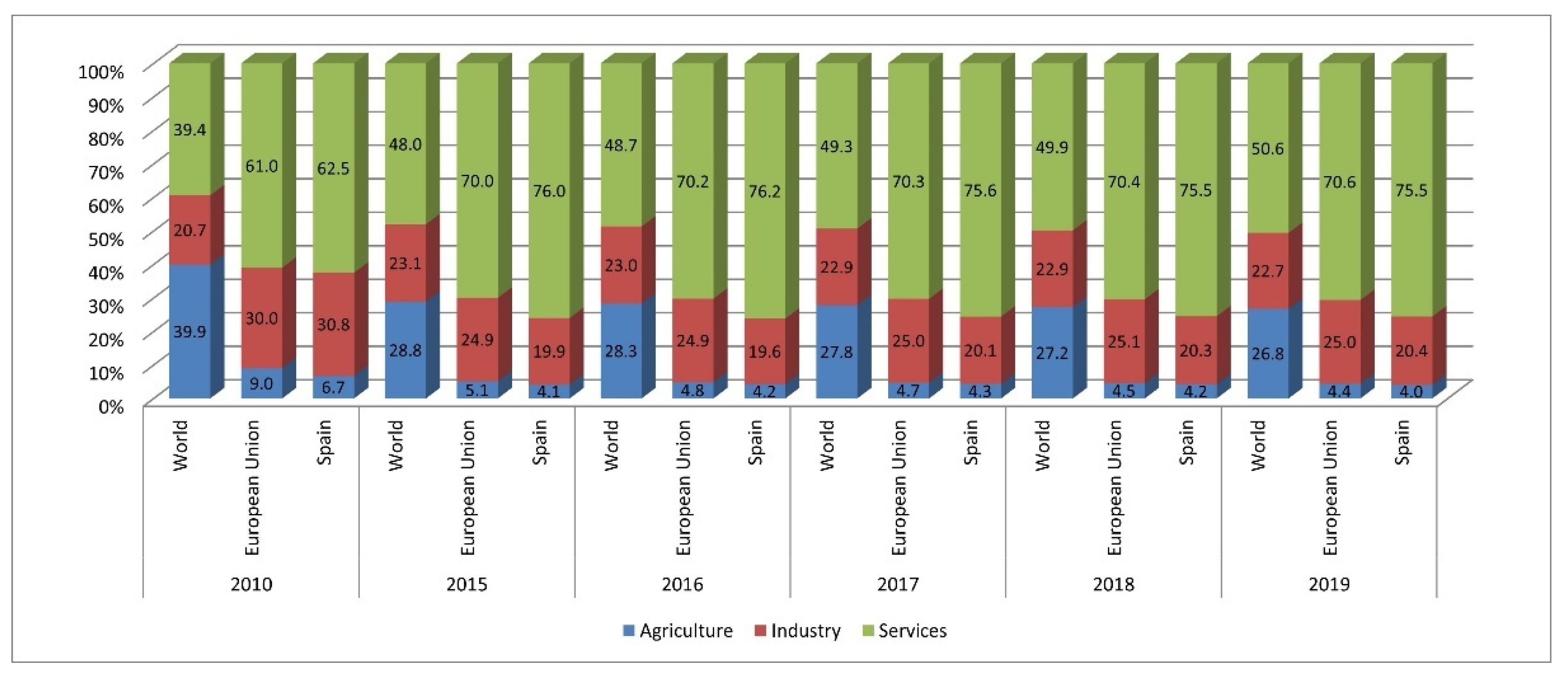

. 1 2020 and Sept. This map shows state gas tax rates as of July 2021 using recently released data from the American Petroleum Institute. Thats because the tax policies built into the bill target those with an income of 75000 per year or less about 65 percent of American taxpayers.

2021 Combined Applicable Motor Fuel Tax Rates per Gallon Effective July 1 2021 Created Date. This booklet contains information for your 2022 Michigan property taxes and 2021 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program. The 2022 state personal income tax brackets are updated from the Michigan and Tax Foundation data.

At the beginning of the last legislative term Gov. Diesel Fuel 263 per gallon. For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is.

Alternative Fuel which includes LPG 263 per gallon. 1 2020 and Sept. The cost of vehicle registration isnt the only travel related price increase coming in 2017.

An assessment by Multistate Associates a state and local government relations firm says that there is a significant risk that Michigan raises taxes in 2021. If 2021 inflation is 5 or more then the fuel tax will be increased to 277. Gasoline 263 per gallon.

The tax on regular fuel. Michigan tax forms are sourced from the Michigan income tax forms page and are updated on a yearly basis. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St.

Didnt gas taxes just go up. Michigan Gas Tax Increase on Audacy. Michigans excise tax on gasoline is ranked 17 out of the 50 states.

COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed. Michigan fuel taxes last increased on Jan. And theyre expected.

The increase is capped at 5 even if actual inflation is higher. As of January of this year the average price of a gallon of gasoline in Michigan was 237. Potential Increases and Reforms in 2021 Mackinac Center Policy Forum Virtual Event.

The current state gas tax is 263 cents per gallon. A 45-cent tax increase per gallon of gas. The authors create an interesting framework to highlight some factors that lead to tax hikes and Michigan triggers a number of them.

When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US. The size of the January 2022 fuel tax increase will depend on how much the consumer price index has risen between Oct. They note that the governor supports increased taxes.

Talking Michigan Taxes. Utahs gasoline tax saw a small increase in 2021 by 3 cents for every 10 gallons. 5252021 90510 AM.

The price of all motor fuel sold in Michigan also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. Some state and local officials are now using potential revenue losses from the COVID-19 crisis. Michigan drivers pay 42 cents per gallon in state gas taxes.

Call center services are available from 800am to 445PM Monday Friday. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. New Developments for Tax Year 2021 Income Tax Self-Service New Developments for Tax Year 2021.

To offset the gas tax increase for lower-income residents this proposal would incrementally double the Earned Income Tax Credit EITC from 6 percent to 12 percent of the federal credit amount starting with a 4 percent increase in FY 2020 and an additional 2 percent increase in FY 2021. 1 2017 as a result of the 2015 legislation. The Times found that the Tax Cuts and Jobs Act will cause automatic stepped tax increases every two years beginning in 2021.

The Utah State Tax Commission adjusts the tax each year. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. Before the official 2022 Michigan income tax rates are released provisional 2022 tax rates are based on Michigans 2021 income tax brackets.

Gretchen Whitmer proposed a large tax hike. For fuel purchased January 1 2017 and through December 31 2021. By 2027 these tax increases will impact nearly all Americans except for the extremely wealthy.

The Michigan gas tax will also rise 73 cents per gallon. Federal excise tax rates on various motor fuel products are as follows. Gas prices in 2021 are up more than 1 per gallon compared to a year ago according to the American Automobile Association AAA climbing from 179 in 2020 to 289 now.

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. So far in 2021 inflation has been unusually high. The Michigan gas tax is included in the pump price at all gas stations in Michigan.

The Salt Lake Tribune calculated that would amount to about 162 for the year for a car that gets about 25 miles to the gallon and drives about 13500 miles annually. Michigan Gas Tax 17th highest gas tax. An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon.

States levy gas taxes in a variety of ways including per-gallon excise taxes collected at the pump excise taxes imposed on wholesalers which are passed along to consumers in the form of higher prices and sales taxes that apply to the.

Could Governor Rick Snyder S Proposed Gas Tax Hike Actually Save Metro Detroit Drivers Money Mlive Com

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Sustainability Free Full Text Knowledge Management And Sustainable Balanced Scorecard Practical Application To A Service Sme Html

Coyote Sightings Increase In Mid Michigan Local Abc12 Com

Michigan Breaks Records For Highest Gasoline And Diesel Fuel Prices State Abc12 Com

Why Are Michigan Gas Prices So Much Higher Than Ohio Prices

Whitmer Wants Higher Gas Prices Wsj

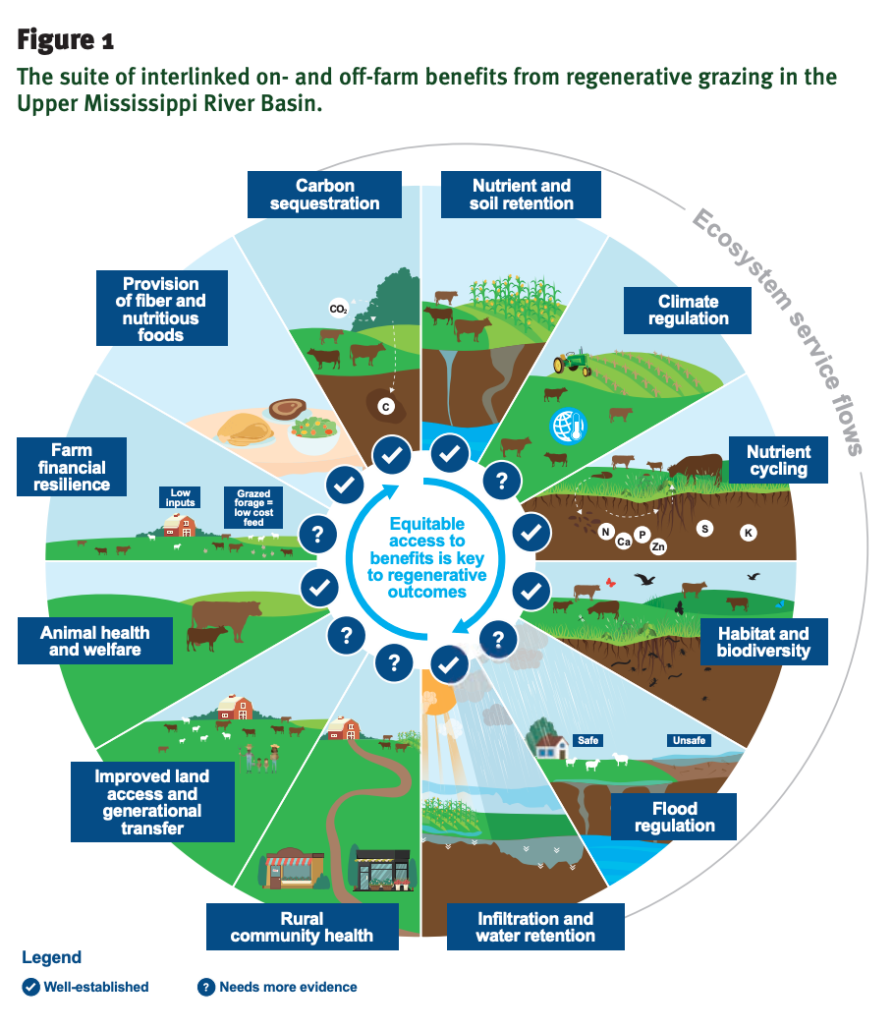

Hope Below Our Feet Regeneration International

Gas Prices In California How Lawmakers Plan To Help Calmatters

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZWHNXJPOCVCOBBYQMG6E6R7A3M.png)

Evers Holds Off On State Gas Tax Suspension Pushes For A Federal One

Michigan At Significant Risk Of A 2021 Tax Hike Mackinac Center

Stellantis Increases Profit Forecasts In Blowout Earnings Debut Financial Times

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax